Legal Lego: Why and how to stack entities on OtoCo

When you build or invest, it's unlikely (and not very wise...) to do things in your own name. Most likely, you'll do stuff from an entity, and even more likely from a number of entities.

Such entities are typically stacked, with one owning the other. In this post, we share some use cases for "nesting" entities and how this can be done using OtoCo.

The use case we present in this blog is identical to a “holding” company with one or more subsidiaries, with both the holding and its subsidiaries formed natively on OtoCo.

Chronologically, the holding needs to come first, as it will own its subsidiaries.

How to do this on OtoCo?

For holdings, a Limited Liability Company (LLC) of which OtoCo offers both an onshore version in both Delaware and Wyoming and an offshore version in the Republic of the Marshall Islands, is a good container to hold assets. Such assets typically include ownership of shares in other companies.

The process to form a holding LLC is the same as any onchain LLC on OtoCo. You first decide which of your wallets you control you connect with on otoco.io, select the jurisdiction, and sign from your wallet paying the ETH equivalent of the one-time formation fee and the corresponding gas fees.

Only seconds later, you will see your new LLC in your dash:

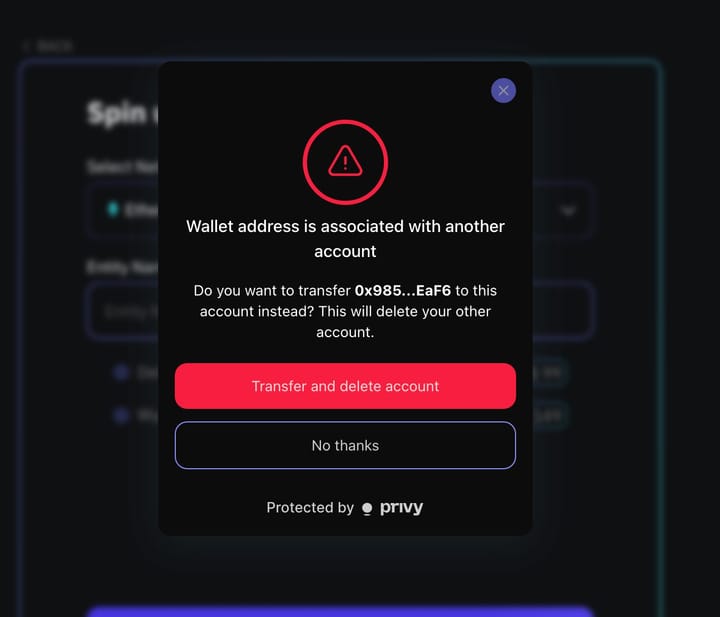

To now make your entity a holding, it needs to own the shares of another LLC. Importantly, this subsidiary LLC cannot be created using the same wallet you used to create the holding with: this would just make it another of your entities directly controlled by you!

Instead, you want the wallet of your new LLC to own the subsidiary LLC. This is easily done in OtoCo: Simply click on the “Entity wallet” plug-in from within your dash:

This Entity wallet uses Safe multi-sig so it can be configured to have multiple signing parties, but it can also be just controlled by your individual wallet with 1 out of 1 signers.

The analogy of this Entity Wallet in the legacy layer is a bank or brokerage account for your company, which will always need an authorized party to transact on behalf of the company. Using your individual wallet as the authorized signer over the new wallet belonging to your onchain LLC is analogous to you becoming the authorized person over a legacy company’s bank account.

Using this Entity Wallet means all transactions from that wallet will now be done on behalf of your new onchain LLC, including… spinning up a new onchain LLC.

To do this, go to https://app.safe.global/home and click on “Apps” in the left-hand panel menu.

Search for “OtoCo” to access the OtoCo dApp from within Safe:

Connect with the wallet that controls your Entity Wallet on Safe and load it into Safe if it is not already showing.

This means you will now be connected to OtoCo using your onchain LLCs wallet. From here on, all transactions you perform within OtoCO will be done from your entity’s wallet and not your individual wallet. Doing it any other way would mean you are making a fiat payment on behalf of your company from your personal bank account rather than the bank account you opened for the company itself!

Spinning up your onchain subsidiary

Now that you’re connected OtoCo with the wallet belonging to your onchain holding LLC, you will basically repeat the same steps as above to spin up a new LLC.

Again, because it is the wallet of your holding LLC that becomes the first Member of your subsidiary LLC, this subsidiary is now an asset of your holding. Whatever the subsidiary LLC owns will indirectly be held by your onchain holding.

Cascading down

You can now repeat the above nesting process and spin up a wallet for the subsidiary LLC using the Entity Wallet plugin on OtoCo, and use that wallet to spin up another LLC, which would then be the subsidiary of a subsidiary, and repeat this process to layer as many entities you need.

Helpfully, all of them will show up in your OtoCo dashboard with the date of their creation and their unique NFT as “birth certificate” of each entity.

Cross-border setup

A simple holding/subsidiary stack (often still referred to as a “mother/daughter” structure) can be made multi-jurisdictional of the holding is spun up in one jurisdiction and the subsidiaries in another.

This can be particularly useful for US residents who have foreign holdings. You simply spin up a US LLC as the mother to foreign daughters, e.g. a wallet belonging to your Delaware LLC creating a Marshall Islands LLC on OtoCo.

This will greatly reduce your reporting requirements as the holder of shares in a foreign entity vs. you holding the shares in personal name/from a personal wallet: The reporting of foreign holdings would be at the Delaware LLC level, rather than in your personal tax form (Taxation aspects are outside the scope of this post but suffice here to say that tax does not discriminate between offchain and onchain entities…).

Since the onchain Marshall Islands LLC is a separate legal entity for all intents and purposes, i.e. it has its own legal personhood separate from its owners, the above setup allows US-based participants to gain access to investment opportunities that may not be available in the U.S.

For instance, a SAFT can be signed by the Marshall Islands LLC that give rights to a token not offered in the U.S., or you can outright purchase tokens not offered in the U.S. by using your offshore subsidiary.

DAO-controlled onchain entities and multi-member holdings or subsidiaries

Another permutation is when the Entity Wallet is a genuine multi-sig which, by extension, can be a DAO wallet. This means that the holding itself can be controlled by a DAO wallet which sits on top of a cascade of onchain subsidiaries.

A last permutation is to add more owners to the holding and/or its subsidiaries. Note that this use case is different from a DAO controlling an onchain entity: when a DAO controls an OtoCo entity, it still has only 1 owner, be it that the owning wallet can be controlled by multiple signing parties.

To add owners, simply go to the “Add Members” plug-in within the OtoCO dash:

- Add Plugin: Connect your wallet and access the OtoCo dashboard. From the left menu bar, select "Plugins." Click on "Add" to open the Add Members plugin.

- Select Token Type: Choose between "New Transferable Token" or "New Consent Token" based on your entity's requirements. The former will allow any member in your entity to transfer their token to any wallet address, whilst the latter will require consent from a majority of the remaining owners before the smart contract can send the token out.

- Token Settings: In this step, define the new token's fundamental details. Set a unique name, a symbol (ticker), and the total supply for the token.

- Members and Membership Interest: Determine the initial members of your entity and allocate their membership interest in percentage points. By default, your connected wallet will be listed with 100% interest. Use the "+ Add Another Member" button to include additional members by providing their wallet addresses and corresponding allocation percentages.

- Review and Tokenize: Carefully review the entered information and initiate the tokenization process by clicking "Create Mirror Tokens." Confirm the transaction in your connected wallet (e.g., MetaMask) and cover the gas costs.

- Manager and Governance: Designate a Manager for your entity and set the duration of the voting period (in minutes or days) from the available options.

The Entity Wallet you created for an entity you initially owned 100% and to which you then invited more owners will not change the Access privileges, which are set at the Safe level. To add the new owners to the Entity Wallet multi-sig, if desirable, you would simply paste in add them as signatures.

Why multiple entities?

Generally, it is a good idea to ring fence one's assets and exposure as much as feasible. Like bulkheads on boats, the idea is to prevent one flooded compartment from engulfing the rest of your assets.

Limited liability vehicles help compartmentalize ownership. For instance, it makes sense to hold an equity stake you took in a company in a subsidiary that is specially created for this purpose: instead of transferring the underlying assets (the shares in another company) you can just transfer the entity that holds the shares upon sale of your stake. The holding of this special purpose entity then receives the proceeds of the transfer of the shares of the subsidiary.

With OtoCo, such transfer is very easy to do by simply making a new wallet the controlling wallet of the onchain entity, which can be done from the “Manage Entity” section of your dash:

Another reason why compartmentalization makes sense is to limit potential legal liability from owning governance tokens in DAOs. The current lay of the land is that DAOs are not benefiting from legal personhood and limited liability. As a result, DAO governance token holders may be held what is called jointly and severally liable for any liabilities incurred by the DAO, the worst of all worlds!

For instance*: You hold a governance token in a DAO that is deemed to have offered futures on commodities (non-security tokens) without Commodities Futures Trading Commission (CFTC) registration in the U.S. By lack of identifiable persons upon whom to serve notice, all DAO governance token holders are sued by the CFTC (by message in the DAO’s Telegram group).

This means each and every DAO token holder could be held liable for the entire amount the CFTC is seeking. The outcome of such action will be very different if you hold the governance token in a personal wallet (in the extreme, a bailiff appears on your doorstep and empties your house incl. your hardware wallets) vs. you holding the governance token in a single-assert vehicle (the liabilities of which cannot exceed whatever capital you used to purchase the token and which if they liabilities exceed its assets you can declare bankrupt.

*Based on real events…

Be your own family office

Wealthy people have traditionally set up separate entities and convoluted, cross-jurisdictional cascades to shield themselves from potential liabilities, including creditors, frivolous litigation lawyers, envious competitors, etc. and to preserve their wealth.

In our minds, the injustice is not in them having access to such wealth preservation tools, but to maintain legal cartels and erect analog barriers that prevent more people from benefiting from the tools to look after themselves.

Thanks to the accessibility of crypto, most of us will hold multiple digital assets, from NFTs to governance tokens to various coins, however our fear is that many of us hold, stake, swap, trade, transfer, buy and sell their digital assets from wallet they hold personally, or at best from some omnibus legacy holding entity.

With one-time setup costs starting at only US$49, and annual renewal at the same level, OtoCo now makes it easy and extremely affordable to replicate onchain what offchain would require a full family office setup to hold and manage multiple assets.

Try it out for yourself by choosing one of the testnets after connecting your wallet on otoco.io.