Kick off the year with an onchain offshore LLC in the Republic of the Marshall Islands

If you are looking to diversify away from the U.S. whilst maintaining the flexibility of the U.S. Limited Liability Company structure, you can now instantly form a Marshall Islands LLC onchain using OtoCo's smart contracts.

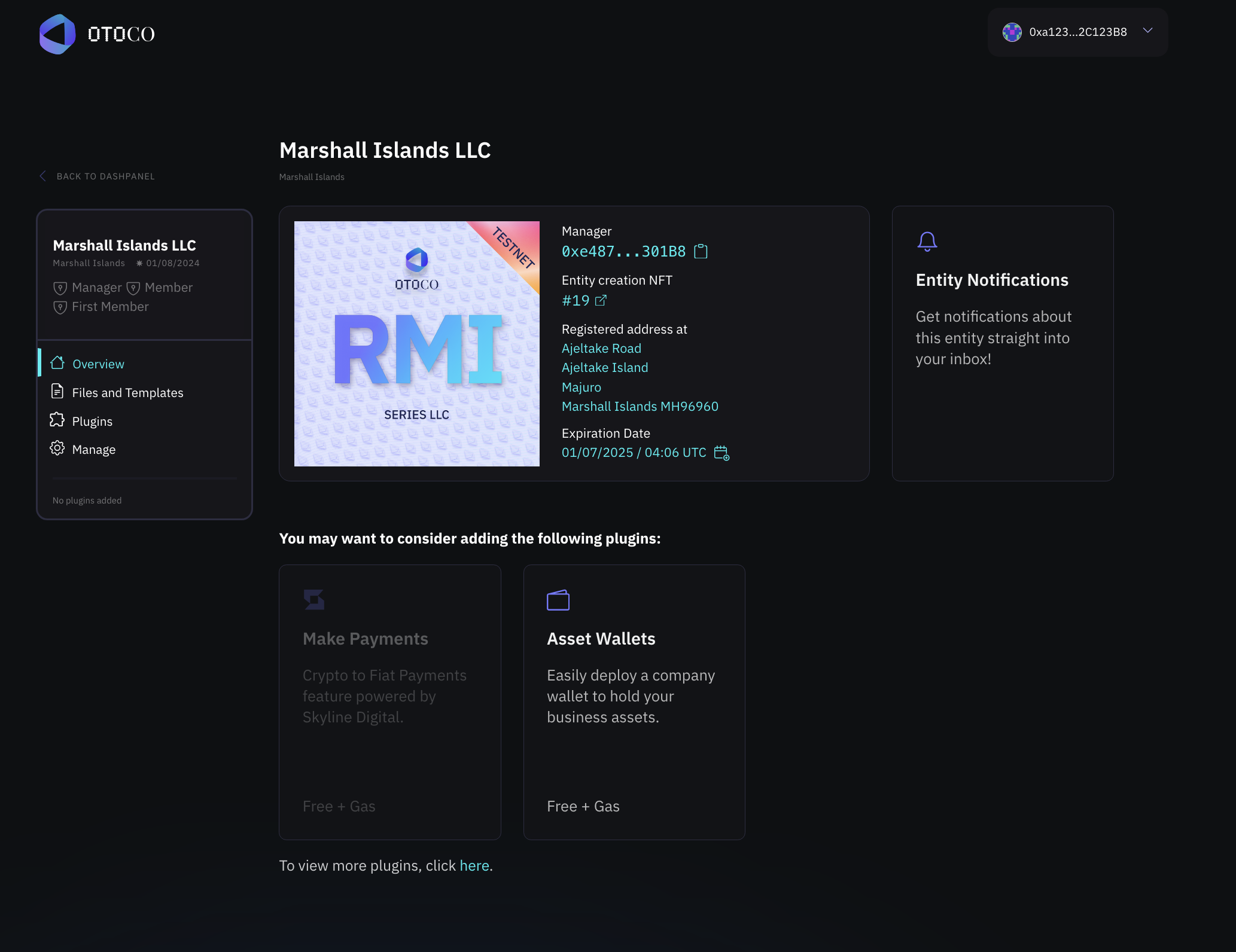

Simply connect your wallet and for the equivalent of only US$149 in Ether (+ gas fees) you can be the instant owner of a hyper-versatile offshore entity in the Republic of the Marshall Islands ("RMI").

When your Marshall Islands LLC is formed, an NFT is created as proof of its existence and you’ll be able to download your long-form operating agreement from within the OtoCo dash.

You can be its sole owner/manager or have more than one member, add bolt-ons such as a digital asset wallet or fiat ramps, and manage your entity entirely from the comfort of your wallet.

A carbon copy of the Delaware LLC

For historical reasons, the Marshall Islands almost word for word copied Delaware's LLC laws, including the existence of Series LLCs in RMI.

Though independent from the U.S., it still looks at Delaware case law if there is no statute or case law in the RMI.

This means the legal OS of its LLC is identical to Delaware's: It has Members (owners) who can also be its Managers (directors), is recognized as an entity with its own legal persona e.g to sign agreements or hold assets, and Members are shielded from unlimited liability, which significantly improves their legal position compared to being a governance token holder in a DAO.

Best of both worlds

As an offshore LLC, the RMI LLC combines the best features of a partnership with those of an International Business Corporation (IBC) in places such as the Cayman Islands or the British Virgin Islands:

- An LLC in RMI allows for tax optimization: Similar to the IBC, LLCs do not pay any taxes at the company level as long as they do not conduct business in the Marshall Islands itself.

- Similar to a partnership, LLC members benefit from limited personal liability in excess of the assets they brought in and can allocate losses and gains with flexibility.

- Privacy: Members' names are not part of any public records and ownership can be entirely foreign, either in personal name or in the name of a foreign entity.

- The minimum number of members is one and the LLC's sole member can also be its manager.

- There is no auditing or accounting required: LLC’s can adopt any accounting criteria and audits are not required.

- English: As a former U.S. territory, English is the official second language in the Marshall Islands.

- The U.S. Dollar is the official currency of the RMI.

Benefits from OtoCo's blockchain-first approach

As it did with the Delaware and Wyoming LLCs and the onchain Swiss Association, OtoCo's tech turns the analog RMI LLC blockchain-first whilst preserving offchain legal validity:

- DeFi-style entity creation: The initiation of the creation of an LLC in RMI with OtoCo is by way of signing a transaction on blockchain from your connected wallet, which will be the first Members and Manager of your LLC. (If you want to try this out before forming an actual entity, you can connect via the Ethereum Sepolia or Polygon Mumbai testnet).

- DAOs can be Members: As a result, not only can an individual wallet be used to form an LLC, you can also use a DAO multi-sig wallet by connecting to OtoCo via Safe's appstore. This means a DAO can effectively own and control an LLC via OtoCo and use it as an extension in the real world to hold real-world assets (RWAs) in addition to crypto, and engage in transactions the DAO itself cannot engage in.

- Flash entities: In addition, formation is instant, allowing users to spin up flash entities with the speed of the Ethereum and Polygon chains. Such flash entities can be useful if e.g. you are set to receive a token airdrop but wish to hold the tokens in the name of an entity you control rather than in personal title.

- Enhanced privacy: OtoCo acts like a VPN around your identity as a Member or Manager: since it is your (or your DAO's) wallet that is Member of the RMI LLC, an extra layer of privacy applies as to who owns and controls the entity. Only when you look to access legacy services such as fiat ramps and bank accounts will you be required to give up a degree of anonymity, but only bilaterally with the service provider you seek to engage with.

- Entity management from the comfort of your wallet: OtoCo lets users manage their entire entity from within the OtoCo dashboard by simply connecting with their Member wallet. From renewals to add-ons such as asset wallets in the name of their LLC, to ultimately folding up their entity, every event is only a cryptographic signature away!

A rainbow of use cases

More than 1,150 users are currently using OtoCo to secure instant limited liability for their project or optimize the way they hold digital assets.

We've seen 3 main categories of use cases:

- Holding entities

We believe it never makes sense to hold anything in personal name. This applies doubly to crypto:

- The OokiDAO case confirmed the status quo analysis that holders of a governance token in a DAO are considered unlimited partners and can be held jointly and severally liable for the actions of the DAO. This is the worst of all worlds but can easily be remediated by spawning a cheap and instant entity using OtoCo. Some of our users have one entity per governance token they hold!

- Tax reporting is typically a lot more convoluted at the individual level, where every transaction needs to be accounted for, versus a holding company level, which can summarize its accounts by looking at the begin and end value of its holdings over the reporting period, and what distributions have been made to its Members in the case of an LLC. It then falls on those Members who receive distributions out of an LLC, including an RMI LLC, to comply with any applicable individual reporting requirements in the country they are tax resident.

- OtoCo has a plug-in that lets the entity itself, once formed, control a multi-sig using Safe technology. This makes it unambiguous that the digital assets held in the wallet are assets of the company and not of the individual Member(s). In the case of the RMI entity, since it has its own legal personhood, it can hold assets that may otherwise not be available or may be considered securities in the jurisdiction where its Members reside. In this respect, the insertion of an offshore entity, in this case an RMI LLC, broadens the democratization of token holder participation.

- Operational entities

The shortcomings of DAOs, in the current analysis, are well documented: they do not benefit from limited liability and are not considered legal persons separate from their members.

As a result, there is a lot DAOs can't do: often, counterparties do not want to enter into agreements with them, and centralized exchanges, banks and tradfin service providers won't open an account for them.

Building a project with a DAO as the operating entity is not only difficult, it is borderline foolish as you take entrepreneurial risks without limited liability protection.

However, "wrapping" your DAO which is generally advocated by lawyers (who try to look cool using the word "legal wrapper") in our minds is also very unsatisfactory, as it essentially shoehorns the spontaneity and openness of a DAO community into the straightjacket of a traditional company structure.

Much preferred is have your DAO control a legal entity. With this in mind, OtoCo has made sure its solution interfaces with Safe's multi-sig smart contracts, which means an entity, including the RMI LLC, can be owned by a multi-sig wallet. Such wallet can belong to a DAO or to a project's Foundation and its access privileges are set by your project's governance protocol.

The end result is that an entity spun up using OtoCo's smart contracts can be owned and controlled by your DAO or decentralized Foundation and used as their operational extension in the real world, rather than the DAO itself being wrapped in an existing company form.

This opens up a whole new world of legal configurability in which an RMI LLC can be the operating subsidiary of a decentralized project.

- Multi-member capital pools

Then last prevalent use case for an onchain LLC, whether onshore or offshore, is to pool capital from multiple members and give each governance rights over how such capital is to be deployed.

Such governance rights are granted by way of the issuance of a "mirror token" that reflects how much funds each Member has contributed.

OtoCo's multi-member smart contract plugin lets users issue such token which can then also be used as a voting card to co-decide what the pool will be investing in.

Further questions

The OtoCo team is available via its public Telegram channel to take any questions users may have on our new Marshall Islands product or any other OtoCo solution.

As a final note, and in anticipation of some questions we will no doubt get, the Marshall Islands LLC you form with OtoCo is not a Marshall Islands "DAO LLC" (see our June 2023 blog specifically about the RMI DAO LLC).

Such "DAO LLC" is in many ways a customized LLC meant to cater to the needs of DAOs and Web3 projects but differs in a number of significant ways from the main LLC, most crucially in that for-profit DAO LLCs are considered domestic Marshall Islands entities and hence attract a tax on their gross revenues, currently set at 3%.

The main (Delaware-copy) LLC is not a domestic entity and hence no tax applies to its gross revenue nor its profits.

Disclaimer: Not tax or legal advice.