New Requirements for Marshall Islands Entities: Migrate Your OtoCo Entity Today

The Republic of the Marshall Islands (RMI) is increasing oversight of the activities conducted by companies incorporated there, including LLCs created through OtoCo's platform.

The Company Registry in RMI requires users who form an entity there to seek approval of its activities before it proceeds with incorporation.

This permissioning is in contrast with "unpermissioned" jurisdictions, primarily the U.S. generally and U.S. states such as Wyoming and Delaware in particular, which do not impose controls at the moment of formation.

Monopolist power

OtoCo provides all users of entities formed via its onchain entity creation protocol with a registered address and registered office in RMI.

This is required to validly establish a company in RMI, even if such company is considered "non-domestic", which is the case for all OtoCo LLCs and allows them to benefit from zero tax in RMI (compared to domestic "DAO LLCs" which if engaged in for-profit activities attract a 3% tax on revenues).

OtoCo provides such registered address and local agent via the Trust Company of the Marshall Islands (TCMI), the sole authorized agent in RMI who effectively has a monopoly on all non-domestic company formations there: If TCMI ceases to provide registered agent and office service to RMI entities, the Company Registry will dissolve them.

This means that TCMI effectively gates what companies can be formed in RMI, irrespective of company type and whether they are stand-alone LLCs or Series LLCs.

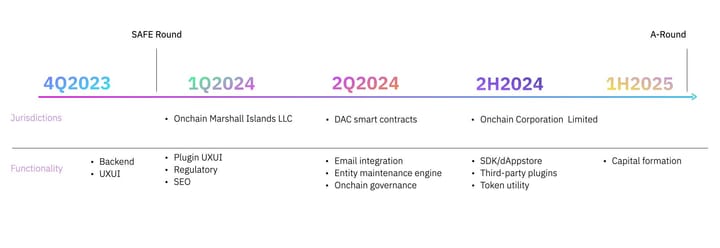

Since late 2023, TCMI has provided registered office and acted as registered agent to all OtoCo entities in RMI, without requiring our users to seek approval for their activities.

Series LLCs spun up via OtoCo benefited from their Master LLC's registered address and office, which only had to be paid for once. This, together with the automated minting of companies on blockchain, helps explain how OtoCo can keep cost down to only a couple of hundreds of dollars in annual dues.

However, with increased regulations, especially Virtual Asset Services Provider ("VASP") regulations in RMI that impose a license on certain token-related activities, TCMI now requires OtoCo to gather more information on its users and seek pre-approval for their activities, not only for future RMI entities minted via OtoCo's smart contracts but also from its existing users.

Until we do so, we cannot form new entities in RMI, which is why minting new OtoCos in RMI has been disabled on otoco.io.

What does this mean if I have an RMI company on OtoCo?

Existing users too are affected and if you currently have an RMI on OtoCo, you have the following options:

Option 1: Re-domicile to Wyoming or Delaware at no cost

You have the option to create a fresh, new Protected Series LLC using OtoCo's protocol in either Wyoming or Delaware at no cost for the first year.

These U.S. jurisdictions offer series LLC structures that are nearly identical to those offered by OtoCo in the RMI. In fact, RMI almost entirely copied over its LLC laws from Delaware!

However, the additional advantage of re-domiciliation to the U.S is that you will benefit from access to the U.S. financial infrastructure, including crypto offramps and bank accounts.

On the tax side too, re-domiciliation should be neutral:

- The default tax treatment of both Delaware and Wyoming LLCs is that they are "pass-through" entities. This means that the entity as such is not taxed, only its members (you as owner and others in the case of a multi-member LLC) if and when they receive distributions out of their LLC.

- For non-U.S. owners, this means such distributions will be reportable in the tax jurisdiction where they are resident.

- For U.S. owners, they would have reported distributions from their RMI entity anyhow as foreign income, the same way they will now report distributions (if any) from their U.S. LLC.

There is of course some nuance to this so please seek independent tax advice.

Option 2: Form a standalone LLC in RMI

If you still wish to operate as an RMI entity, we’ve partnered with Otonomos to offer standalone LLCs at a special one-time formation fee of US$550 (reduced from US$810) plus annual dues of US$1,400, which includes a US$650/year Government fee.

1) Otonomos will separately file for your LLC as a standalone entity. You will need to provide Otonomos with details of ownership and activities of your company, and your registration will be subject to approval by TCMI as per above.

2) You will enter into a service agreement with Otonomos and will be able to manage your RMI entity from your online dashboard, including paying for annual fees and instructing filings, create resolutions, etc.

3) If once approved, TCMI believes your activities fall within the VASP or other regulated scope, it may resign as your registered agent and registered office provider and your entity will be dissolved.

NEXT STEPS

We will reach out to each OtoCo RMI owner individually by email to assist with their migration.

- If you choose to re-domicile, you will be able to do so directly on otoco.io and get refunded for the US$49 one-time activation fee.

- If you decide to stay in the RMI, Otonomos will process your RMI formation on a priority basis.

Please be on the lookout for a follow-up email that will be sent to all affected users.

How do I transfer assets from my OtoCo RMI entity to my new entity?

Once your new entity is created, either in the U.S. or in RMI, you can assign or pledge any assets, wallets, agreements or contracts previously held by your legacy entity to your new company. This ensures minimal disruption to your operations.

For wallets managed under your OtoCo RMI entity, you can do the following:

- Transfer the wallet's holdings to a new wallet owned by your new entity. If you created a WY or DE on OtoCo, first create a multi-sig wallet using the plug-in from your dash and then transfer the digital assets held by your legacy RMI.

- If you have an existing Safe wallet that belongs to your RMI, you can also simply transfer its controller to your new U.S. entity from within the OtoCo dash.

- You can also fill out an asset pledge document which OtoCo will provide to formally pledge the previously held assets and wallets to your new entity.

- Legal agreements previously signed with your RMI OtoCo can simply be novated or re-assigned.

Please reach out to community@otoco.io if you have any question.

FAQs

What happened to my RMI Series LLC?

Even if we gather information from all existing users as to their activities, seeking approval from the Registry for each individual Series would take time and is estimated to cost users more than migrating to a new entity.

Therefore, once everybody who wishes to migrate has done so, OtoCo will liquidate the Master, which will leave the Series as orphans.

Why did this happen now?

While your entity was allowed to form and operate until to date, only recently is TCMI seeking to reassert control over the activities conducted by entities on OtoCo.

While the official reason given is that some of these entities may engage in licensable activities incl. the provision of Virtual Asset Services, the simpler explanation is that OtoCo ultimately represents a threat to TCMI's monopoly on the formation of non-domestic entities in RMI.

Some members of the community suspect collusion between MIDAO as the monopolist agent for domestic DAO LLCs and the Registry, but we have no evidence as such.

Can I reinstate my RMI Series LLC?

You could form a new Master LLC e.g. via otonomos.com and create an offchain Series but would need to be approved by the RMI Registry.

However you would not be able to reinstate your OtoCo Series LLC under OtoCo's Master, which under the laws of RMI could only be reinstated by way of a lengthy and expensive court procedure and which even if restored would force users to seek approval for their activities.

Will OtoCo resume its instant onchain entity creation in RMI?

We do not like permissioning of any kind and RMI's approach blocks the instantaneousness of entity formation by gating who can incorporate in its jurisdiction, standing in the way of new technology and raising costs.

We may be considering offering RMI Series again, but only if we feel the regulator is open to innovation instead of shielding monopolists. Users should probably not hold their breath...

More likely, OtoCo will port existing RMIs to blockchains, once they have been approved offchain, and do the same in other jurisdictions e.g. the B.V.I.

Are other jurisdictions affected?

No, this only affects OtoCo RMI LLCs. Our Delaware and Wyoming offerings remain operational and legally compliant, and so does our Swiss Association product.

Can I transfer my wallets and assets to a new entity?

Yes, and we recommend you do so (see above). You may assign or pledge control of wallets, IP, or assets previously held by your RMI Series to a new Series LLC formed via OtoCo or any offchain entity, including a stand-alone LLC in RMI.

Will this impact my taxes?

Likely not, since LLCs are pass-through entities (see above). However, consult a tax advisor familiar with your local jurisdiction.

Disclaimer

This communication is for general informational purposes only and does not constitute legal, tax, or financial advice. You should consult your own legal or professional advisors regarding your specific circumstances. OtoCo is not a law firm and does not offer legal services. The formation, management, and dissolution of legal entities involve jurisdiction-specific laws and evolving regulatory interpretations.