LIVE NOW: Let Genco AI Handle Your Year-End LLC Tax Forms

Running a U.S. company as a non-U.S. owner can be empowering — but U.S. tax compliance often feels confusing, especially when you don’t actually operate in the United States.

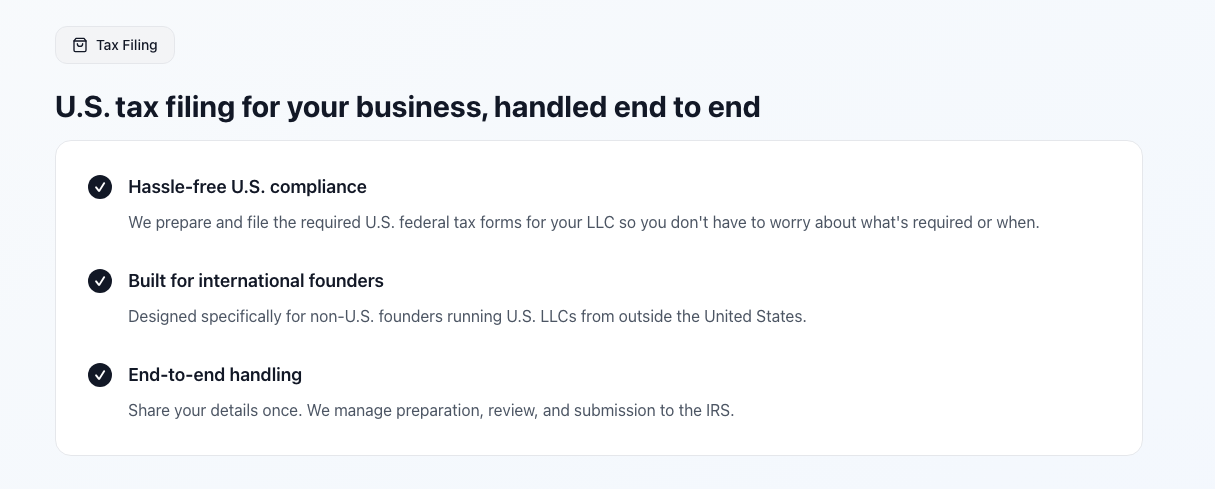

That’s why we’re excited to announce our new Tax Center within Genco, designed to make U.S. tax compliance simple, repeatable, and stress-free for the majority of international founders.

(Takes only ~5 minutes of your time)

Why We Built This

Over the past year, many founders asked us the same questions:

- “Do I need to file U.S. tax forms as an owner of a U.S. LLC even if I don’t live there?”

- “I invoice U.S. clients but operate my LLC from abroad, do I owe U.S. taxes?"

- “Why does everyone make this harder than it needs to be?”

We looked around and found that:

- Most tax solutions are built for U.S.-based businesses

- International founders are often overcharged and under-served

- Simple compliance filings are bundled with unnecessary complexity

The reality is that most foreign founders fall into a very common, simple category: they live and work outside the U.S. and only need to file basic, required compliance forms each year.

So instead of forcing founders into complex tax software or expensive accounting retainers, we built a focused service that does exactly what’s needed — and nothing more.

Who Is This Tax Filing Service For?

In simple terms, if you live and work outside the United States and own a U.S. LLC, OtoCo’s Tax Filing service was built for you.

This service is designed specifically for founders who meet all of the following criteria:

- You are not a U.S. citizen

- You are not a U.S. tax resident

- You live and work entirely outside the United States

- You own a U.S. LLC (for example, in Wyoming or Delaware)

- Your business has:

- No U.S. office

- No U.S. employees

- No work performed while physically in the U.S.

You may still:

- Have U.S. customers

- Invoice U.S. companies

- Use U.S. payment platforms like Stripe

- Have a U.S. bank account for your LLC

- Even have a U.S. visa that allows you to work in the U.S., as long as you do not perform work for the foreign LLC whilst you are in the U.S.

What matters is where the work is performed, not where your clients are located.

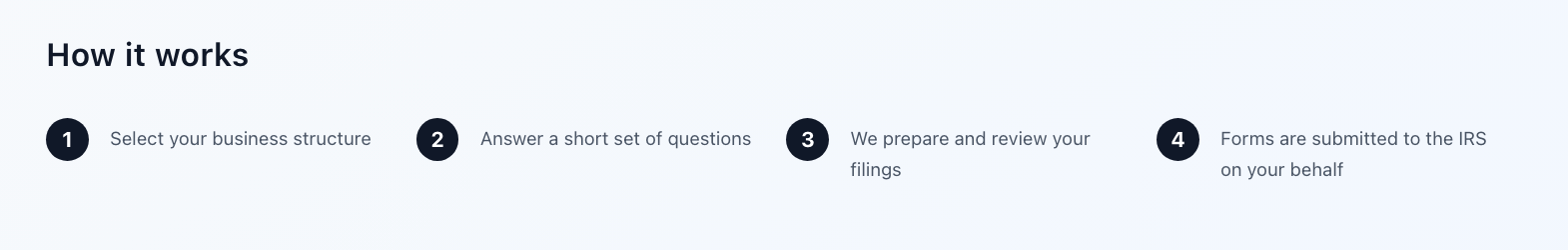

How the Process Works

Our tax offering focuses on required U.S. Federal compliance filings for foreign-owned LLCs that do not have U.S. business activity.

We designed the experience to be as simple as possible:

- First, you purchase the appropriate tax filing product from the Tax Center.

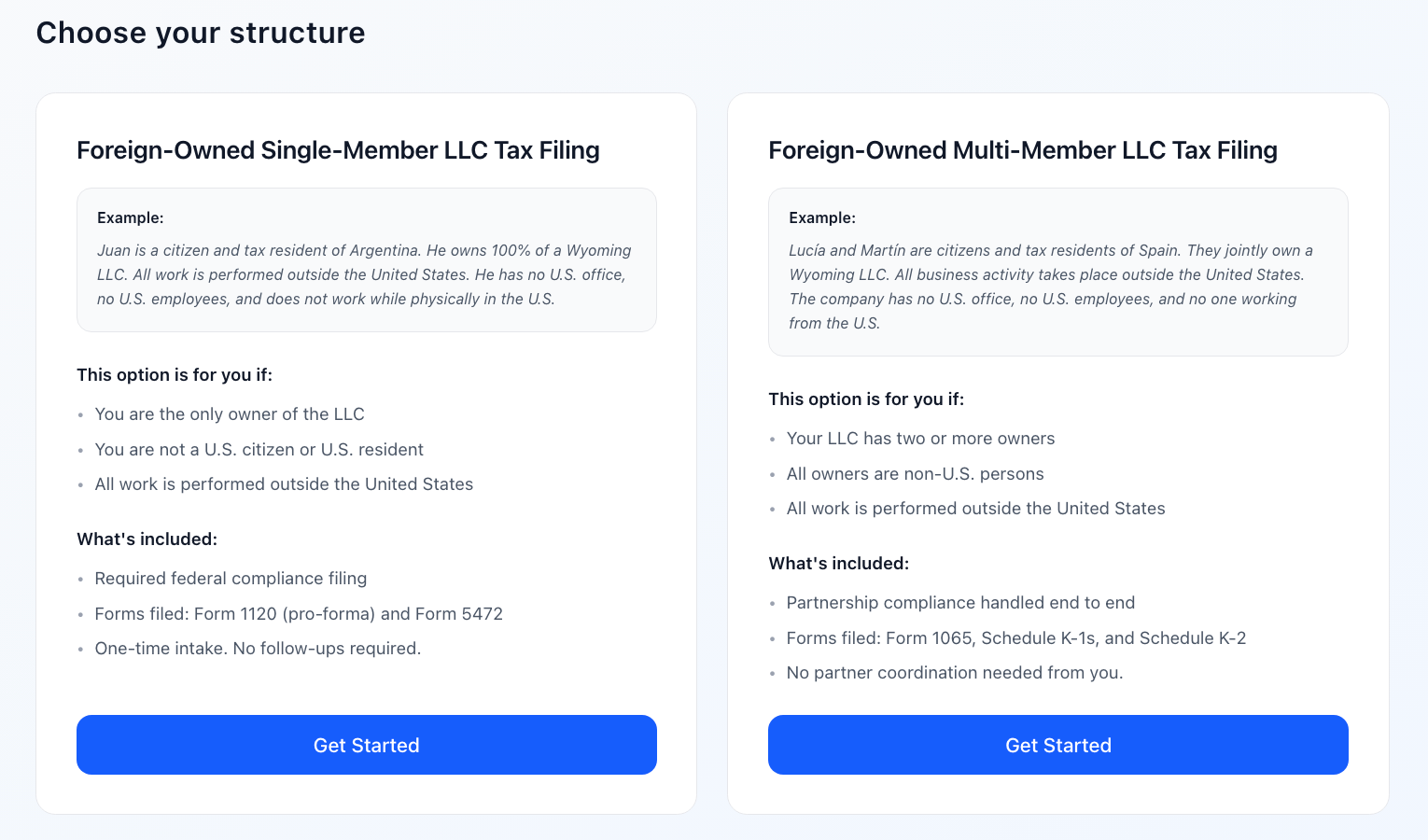

There are two products, depending on your LLC structure: Single-Member LLCs or Multi-Member companies.

Foreign-Owned Single-Member LLC Tax Filing: $499 per Tax Season

Foreign-Owned Multi-Member LLC Tax Filing: $899 per Tax Season - You'll then be prompted to answer a short set of questions.

- Genco AI then collates your answers and prepares your filings.

- Your forms are submitted to the IRS using trusted third-party tax professionals.

There’s no tax software to learn, no paperwork to manage, and no ongoing back-and-forth.

Not Sure About Whether to File or Deadlines? Genco Has The Answer!

If you’re unsure whether you need to file, if your situation has changed, or which deadlines apply to your LLC — ask Genco to help you understand your obligations so you don’t miss a deadline or get caught out.

👉 Head to Genco and describe your situation in a few sentences.

Tax filing services are provided by independent third-party tax professionals. OtoCo is not a CPA firm, law firm, or tax advisor and does not provide tax, legal, or accounting advice.

By purchasing OtoCo products or services, you agree to our Terms of Service and Privacy Policy and acknowledge that OtoCo does not provide tax advice. If you are unsure about your tax situation or eligibility, you should seek advice from a qualified tax professional before proceeding.

Information you submit may be shared with trusted third-party service providers solely for the purpose of preparing and filing your tax returns.