The Swiss Foundation is dead. Long live the Swiss Association - now onchain on OtoCo!

Swiss Associations are widely used as shared platforms by global service providers. OtoCo now lets users instantly create a Swiss Association natively on blockchain and decentralize its governance.

A new legal lego brick

OtoCo is very happy to introduce the blockchain-native Swiss Association, its first onchain limited liability entity outside of the U.S.

For only US$99 equivalent in ETH (+ transaction fees), you can now instantly summon and activate an association in the Canton of Zug and manage it fully onchain on OtoCo.

You get a timestamped NFT as its cryptographic birth certificate and a downloadable PDF which gives your onchain entity a realverse legal anchor.

With this new onchain limited liability entity, OtoCo provides the Web3 community with an extra legal lego outside the United States, at a time when many crypto teams are considering setting up shop abroad.

In what follows, we first look at the characteristics of a Swiss Association and its potential as the umbrella for decentralized projects and DAOs.

We then contrast the Swiss Association with the Swiss Foundation.

Finally, we guide users through the Association creation steps on OtoCo.

I. The legacy Swiss association incarnation

In its simplest appearance, think of an association as a local club. Your local junior football team is most likely an association, and so is your local school’s chess club.

But also large-scale organizations such as the World Wildlife Fund and FIFA are associations in Switzerland, and so are legal and other professional firms.

Takes two to tango

In Switzerland, such association is known as a Verein in German1, and is a genuine limited liability entity under Swiss law with separate legal persona, unlike Anglo-American voluntary associations.

All that is required to incorporate an association is for a minimum of two initial members to decide on a common purpose and sign their association’s articles.

Since Swiss associations are not required to have a Swiss resident board member and its members can be individuals or legal entities, such incorporation can be done from anywhere around the world.

In addition, there its no filing requirement to create a Swiss association.2

These combined features means that a Swiss association can be validly created by way of a multi-sig transaction between two independent wallets to indicate agreement on a common purpose and articles.

This is in essence how OtoCo engineered its association genesis smart contract, and we will have a closer look at how we made this work in Part III below.

Before we do so, let’s understand the use of the Swiss association by traditional service providers, first and foremost by… lawyers, who are not otherwise known as chief innovators.

Of all people

Some legal services firms, for instance Baker & McKenzie, Dentons, DLA Piper, and Hogan Lovells, while typically setup as partnerships in the countries they operate, are collectively organized as Swiss associations.

Such setup sought to reconcile a number of requirements:

- How can we unify a number of geographically dispersed and generally independent units under the same brand? For many professional services firms, to be seen as a “one stop shop” with presence in multiple locations, even though internally each office is operating independently, can be hugely advantageous.

- How can we keep local or regional profit pools and their related tax, accounting and partner compensation systems separate while allowing strategy, branding, information technology and other core functions to be shared between the constituent partnerships?

- How can we make sure that each partnership has limited liability vis-à-vis each other partnership, to avoid that partners in say the London office of Hogan Lovells are not liable for the actions of their partners in say Buenos Aires?

- How do we prevent the homegrown culture of each partnership from diluting?

- How can we expand internationally in a modular way, without the need for merging operational units and sharing profit pools?

It is arguably the ease of international expansion that has prompted a fair number of legal and other professional services firms to look at the Swiss Association as a possible umbrella for their international offices:

- There is huge strength in being able to add more “chapters” globally without diluting local profit pools, while maintaining separate legal liability between each member.

- Tax-wise too, after amalgamation, each member remains under its home-country regime.3

- Finally, culturally people feel part of a bigger story and work under a unified brand, with opportunities for exchange and secondment, without members losing their identity.

Life’s full of trade-offs

Some of the reasons associations may be less suitable to multi-jurisdictional legal services firms4 are more to do with the specific obligations such firms have vis-à-vis their clients, rather than shortcomings of the association structure itself.

However, one question which affects associations perhaps more broadly is how much of a unified culture they can get from running separate P&Ls.

Critics wonder if associations, as used by global professional firms, are not simply marketing platforms without the common culture, standardized practices and sharing of knowledge enjoyed by integrated firms.

For Web3 projects however, being able to hold themselves to the public as one single project while consisting of a loose federation of independent collaborators may be precisely what they are looking for.

Let’s examine this a bit closer in Part II.

II. The Swiss association as a shared services platform for decentralized projects

As indicated above, certain features of the Swiss association may make it eminently suitable as the operational umbrella for a decentralized project.

- Catch me if you can

As we’ve seen, the key feature of a Swiss association, namely that its members remain subject only to their home state regulations and taxation, makes them decentralized by nature and should have obvious appeal to Web3 builders.

For instance, non-US members of a Verein structure are not bound by Securities and Exchange Commission subpoenas from the United States.

In the current environment of regulation by enforcement in the U.S., such compartmentalization has obvious benefits.

Practically, this means that an association can act as the "coordination center” for a number of core development units of a Web 3 project based in various corners of the world, without the risk of regulatory contamination between units (horizontal contamination) and between a unit and the association itself (vertical contamination).

These core units can then each pick the legal setup that works from them depending on where they are based, with some incorporating as companies and other members just remaining unincorporated DAOs, in the knowledge that their association puts liability firewalls between each.5

Likewise, the association’s members (unless they are themselves based in Switzerland) are not being dragged into the jurisdiction of the Swiss courts by virtue of being a member of a Swiss organization, and the Swiss association itself remains in principle untouchable if one of its members misbehaves (or is deemed by e.g the SEC to misbehave) abroad.

- A USB-like port for real-world services

In case (some of the) members are DAOs, they can “port” to the association as the mothership when they need access to real-world services such as fiat banking, legal and accounting support, payroll, etc.

Since DAOs are presently not recognized as separate legal personas, an association controlled by DAOs could become the “handmaiden” of a DAO for everything offchain.

For core units that are incorporated, they too would benefit from the shared services platform the association provides.

For instance, the association could be used to extend health benefits to various contributors of a Web3 project, one of the main reasons why people often prefer to stay in a paid job vs. going independent.

Such private health scheme could be funded by way of membership fees payable to the association, making the health plan fully mutualized.

All payments towards the plan would be made out of the association’s treasury which is controlled by the members.

- Non-profit doesn't mean it can’t make revenue

There’s a fair bit of confusion about the non-profit nature of the Swiss association.

By law, associations are not supposed to be concerned with achieving a financial advantage for themselves, their members or related parties, but only with their non-profit goal.

Such goal, in the context of a Web3 association, could for instance be:

- The growth of a Layer 1 or Layer 2 protocol or decentralized platform

- Using blockchains as a ledger for digital IDs

- Setting up educational centers on crypto

- Promoting the adoption of data storage on decentralized ledgers

- Supporting the growth of a decentralized lending platform

However, while an associations itself cannot be for-profit, it can engage in commercial transactions and it can have subsidiaries that are commercial in nature, provided that their business is in function of the main purpose of the association.

This means associations can have revenue itself (look at FIFA!) and run businesses by way of commercial subsidiaries, as long as the revenue that flows back to them is for the greater glory of the project.

- No need for accounting or audit

If not registered in the commercial register, an association is only obliged to keep summary accounts on its income, expenditure and assets without any filing requirement of its financials.

An audit is not mandatory but can be voluntarily done if so provided for in the association's Articles of Association or by vote in a general meeting.6

- Favorable taxation

The fact that an association is not for-profit does not mean that it is exempt from Swiss tax, which is levied at the federal, cantonal and communal levels in Switzerland and payable where the association is headquartered.

Associations are generally liable to pay tax on profits and assets and this applies regardless of whether associations are registered in the commercial register.

However, there are tax exemptions for Swiss domiciled associations that conduct the majority of their activities abroad, to the extent the other conditions for a tax exemption – in particular the charitable purpose – are still met.

- Members control the association’s treasury

An association’s assets and revenues are controlled by its members.

In a Web3 setup, this means its treasury should be held in a multi-sig wallet in which all or a subset of its members have signing privileges.

If those members are DAOs, this means a collective of DAOs as core units of a decentralized project can control the assets of their shared services platform.

- Membership revenue

Knowing that the main revenue of a non-profit association is by way of membership fees (like any real-world membership club), DAO members of an association can pool resources towards their shared services platform under the guise of membership fees as a way of providing the association with working capital for e.g. joint marketing, events, branding work, advertising etc.

Typically, a small secretariat would be set up to staff and resource such common services platform. This secretariat does not have to be based in Switzerland.

- Democratic governance rights enshrined in the law

Members of a Swiss association, by law, also enjoy protected governance privileges.

For instance, Articles 64 et seq. of the Swiss Civil Code (“CC”), which lays down the regime for associations in all of Switzerland, provides that an association has to have a “General Assembly” that is composed of all its members, and this General Assembly is given reserved powers, most importantly the power to amend the association’s constitution (what we call the Articles of Association or AoA).

Such General Assembly also has the power to nominate (and dismiss) members of the Association’s Board.7

In contrast with a Swiss Foundation, Board members do not have to be Swiss residents and do not even have to be physical persons, making the association a lot more flexible compared to the Foundation.

More generally, the governance of associations is much more freely configurable, with Swiss law laying down the fundamentally democratic ground rules of how associations should be run.

Here too the association provides for much more flexibility compared to the Swiss Foundation

Is the Swiss Foundation dead?

Ask any early Etherean, Vitalik included, whether they regret setting up the foundation for Ethereum in Switzerland and our bet is that most if not all have regrets.

The joy of having to parachute in a local Swiss director! The once a year board meetings in happening Zug! That Foundation purpose which is as unmovable as the Matterhorn itself!

Foundations can have a useful role in a decentralized projects’ entity stack, especially for their ability to extend grants.

But their setup has to be sequenced correctly and if you do need a Foundation, unless you’re courting international Governments or the UN itself, Otonomos has never been an advocate of basing it out of Switzerland.

The main reasons are:

- A Swiss foundation requires registration in a public registry.

- It also requires supervision by a federal authority.

- Its deed cannot be easily changed. As a result, projects that need more flexibility for their operations have to reflect this in their founding deed and make it public. Most find out that it is easier to set up a new foundation than to change the purpose of an existing one.

- The foundation structure is not anonymous, while an unregistered association can be created and exist entirely without public filing.

- A Swiss Foundation will need at least one resident Swiss director. Such Director is often exogenous to the Web3 project, typically charges a hefty director fee, and will want to be indemnified for everything that possibly can go wrong. By contrast, as mentioned above, a Director in an association can be based outside of Switzerland and can also be an entity and - in our analysis and some legal scholars’8, a DAO.

The latter makes it possible for a Swiss association to not only have a DAO as its member but also as its Director, which its something OtoCo can provide for if the members use the tokenizer plugin from within OtoCo’s dash panel and then vote to make one or more members wallets Directors in the onchain association.

Yin and Yang

Why would Web3 projects still want a Foundation, even outside Switzerland?

The answer is that a Foundation and an Association are two very different animals, and play a complementary role in a decentralized stack:

- A Foundation is where core units can get their funding from, after it houses the proceeds from a project’s token sale and lets its token holders decide what core units are worthy of a grant via an onchain vote e.g. on Snapshot.

- An Association is where such core units are a member of once they received working capital from the project’s Foundation by way of grant, when they want to realize economies of scale by pooling some of their capital towards an association as their common services platform.

It’s Ying and Yang when it comes to the relationship between a Foundation and an Association, and in our mind a truly decentralized project that is intent on scaling will eventually need both.

Whilst setting up a Foundation will always involve an analog filing element, including in Cayman where Otonomos spins up most, OtoCo now lets Web 3 projects a solution to instantly and at very low cost create an association for their core developer units to join.

In the next part, we walk readers through how to create such onchain Swiss association on OtoCo.

III. How to create a Swiss association on OtoCo

We made it super easy to spawn a new Swiss Association on OtoCo. Here are the steps:

Step 1: Name and First Members

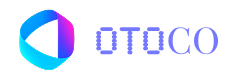

Go to OtoCo’s homepage, scroll down to our product selector and click on Swiss Association:

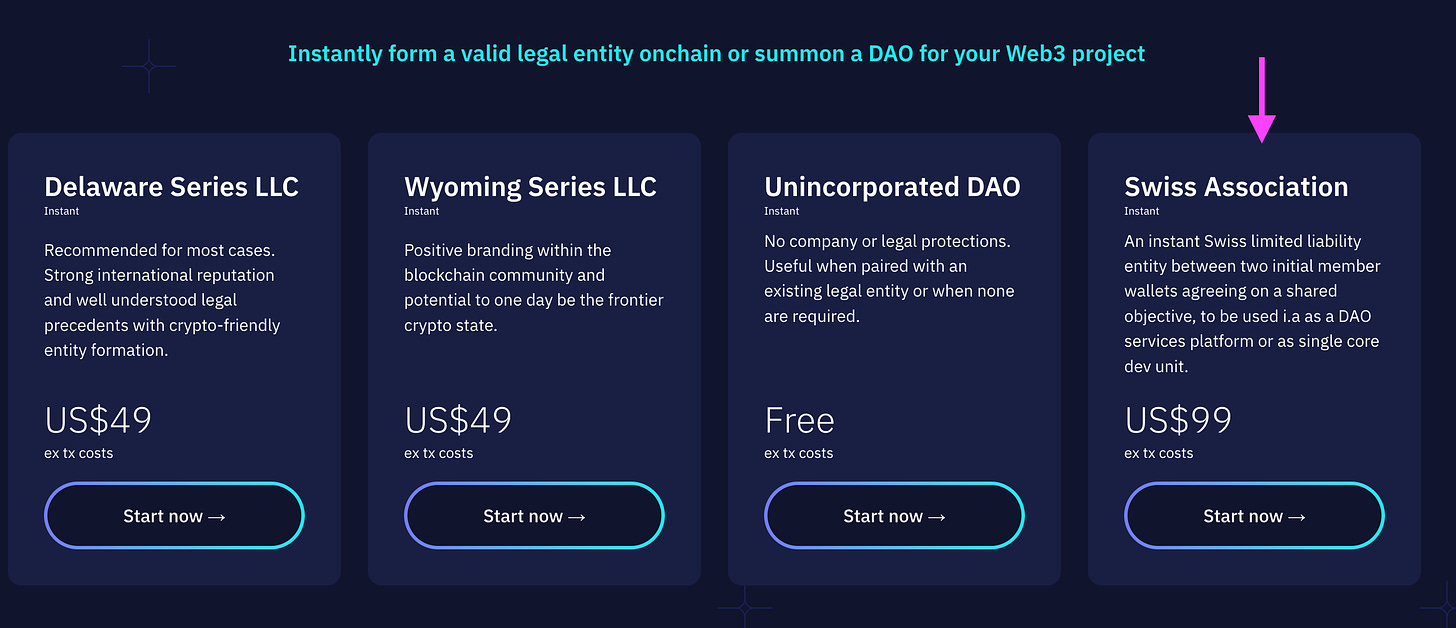

You will be landing on the first screen of the new association creation workflow, asking you to chose a name for it and add its first members:

Note: the below screenshots show the creation workflow on the Goerli test network. Fees for an actual association on main net will be US$ 99 equivalent in Ether + transaction costs.

As explained above, a Swiss association needs at least two initial members to coincide on a common purpose. However you can start with more than 2 members. Because the association initialization smart contract is a multi-sig, all initial members whose wallet you paste in above screen will need to sign to validly constitute your association.

> After your chosen name shows available, click Next.

Step 2: Summon and Purpose

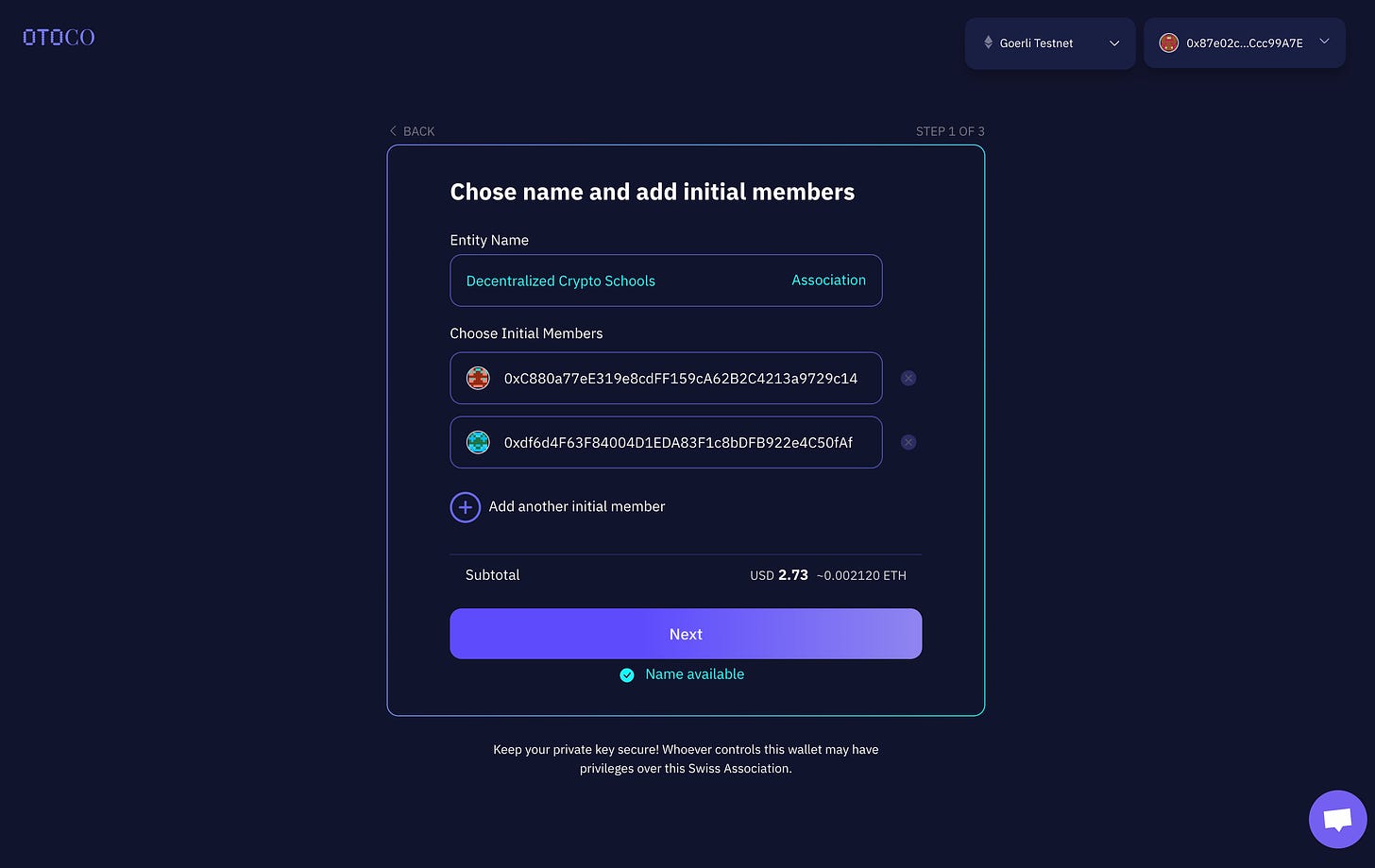

This brings you to an overview screen that shows the genesis NFT for your association which will be etched on your chosen network once your association exists.

It also shows the jurisdiction (Switzerland) and where the association’s registered address will be (Canton Zug).

> Click on Summon Swiss Association if everything looks fine and you’re ready to summon your initial members for the signing ceremony!

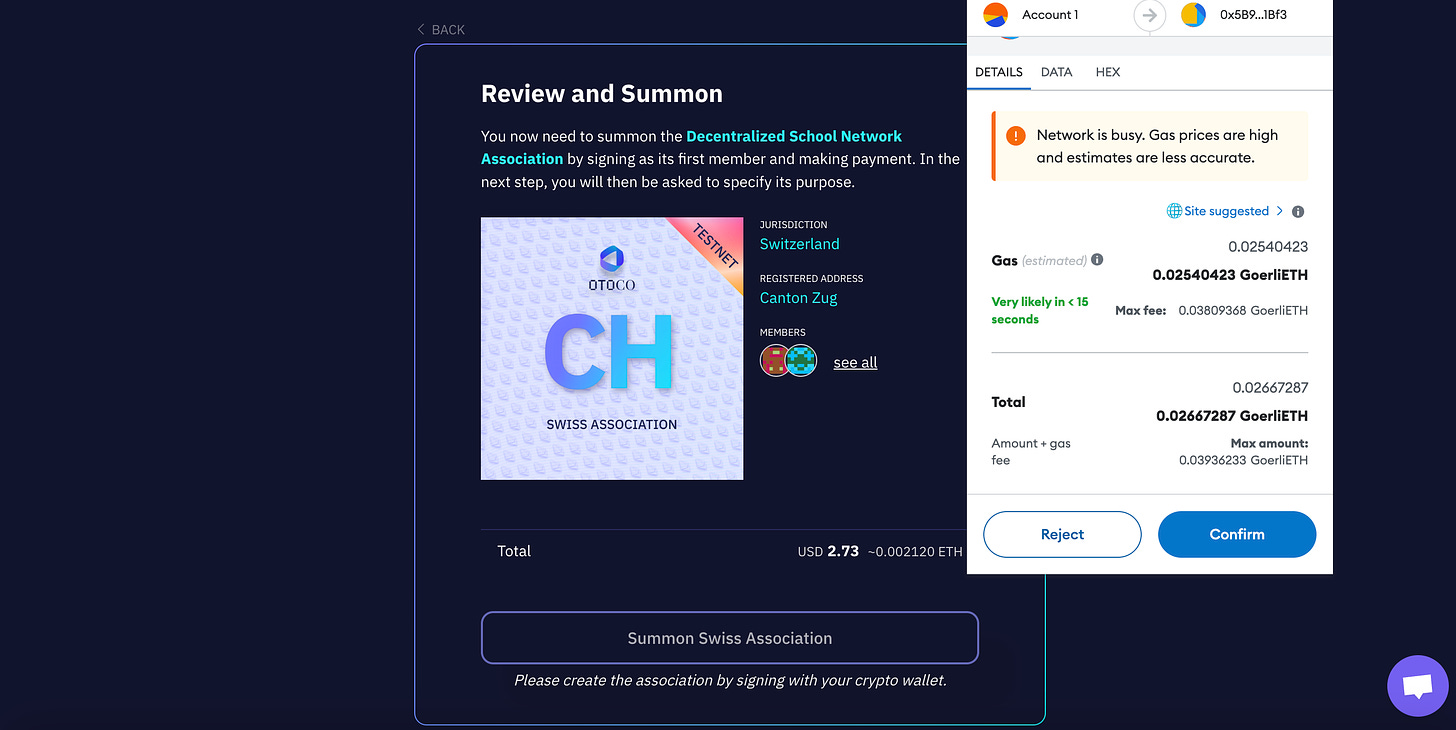

As one of the first members of the association, you will now be asked to sign with your connected wallet ( in our example a Goerli text network wallet via the Metamask browser plugin):

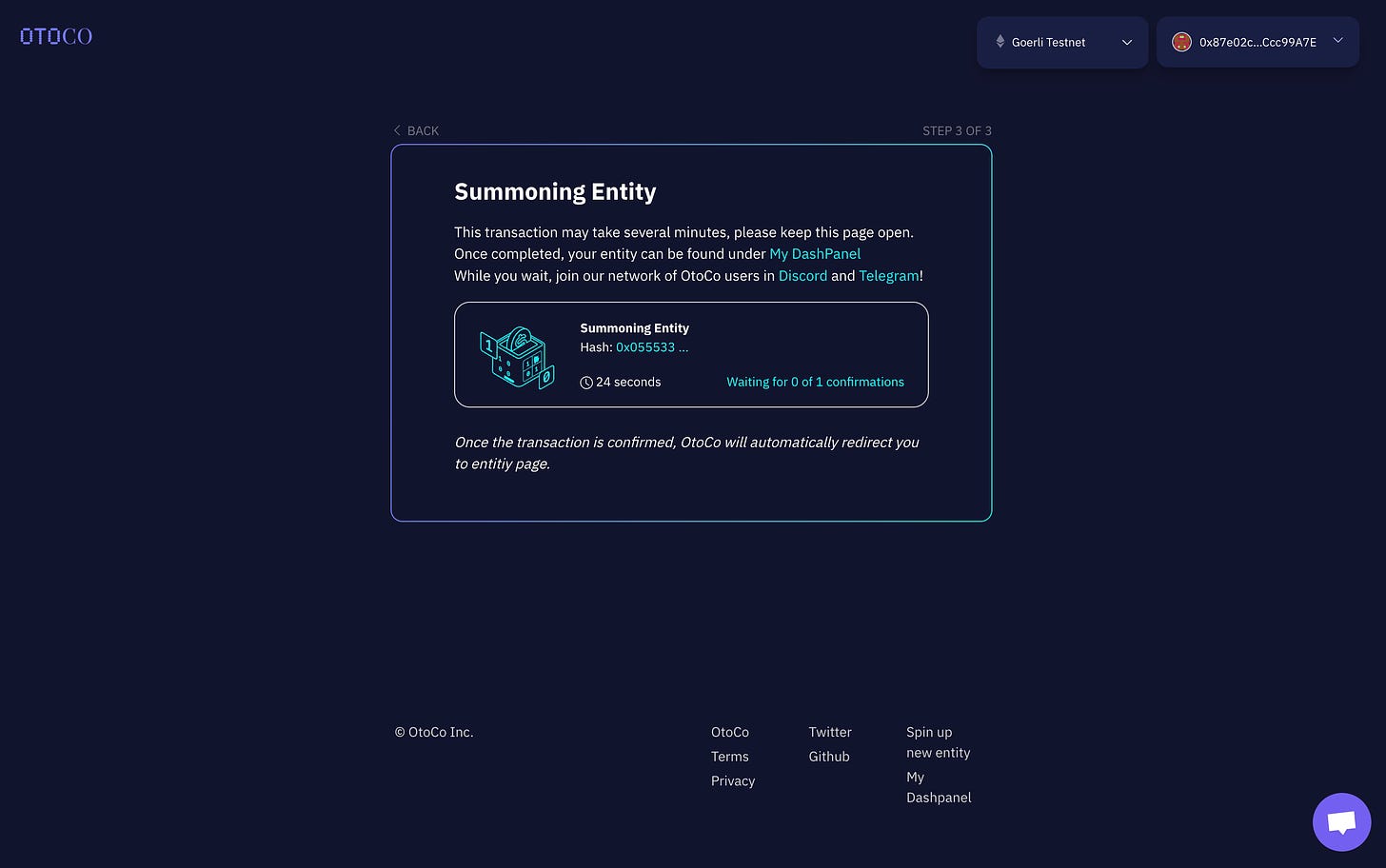

You will see a status screen that your association is being summoned:

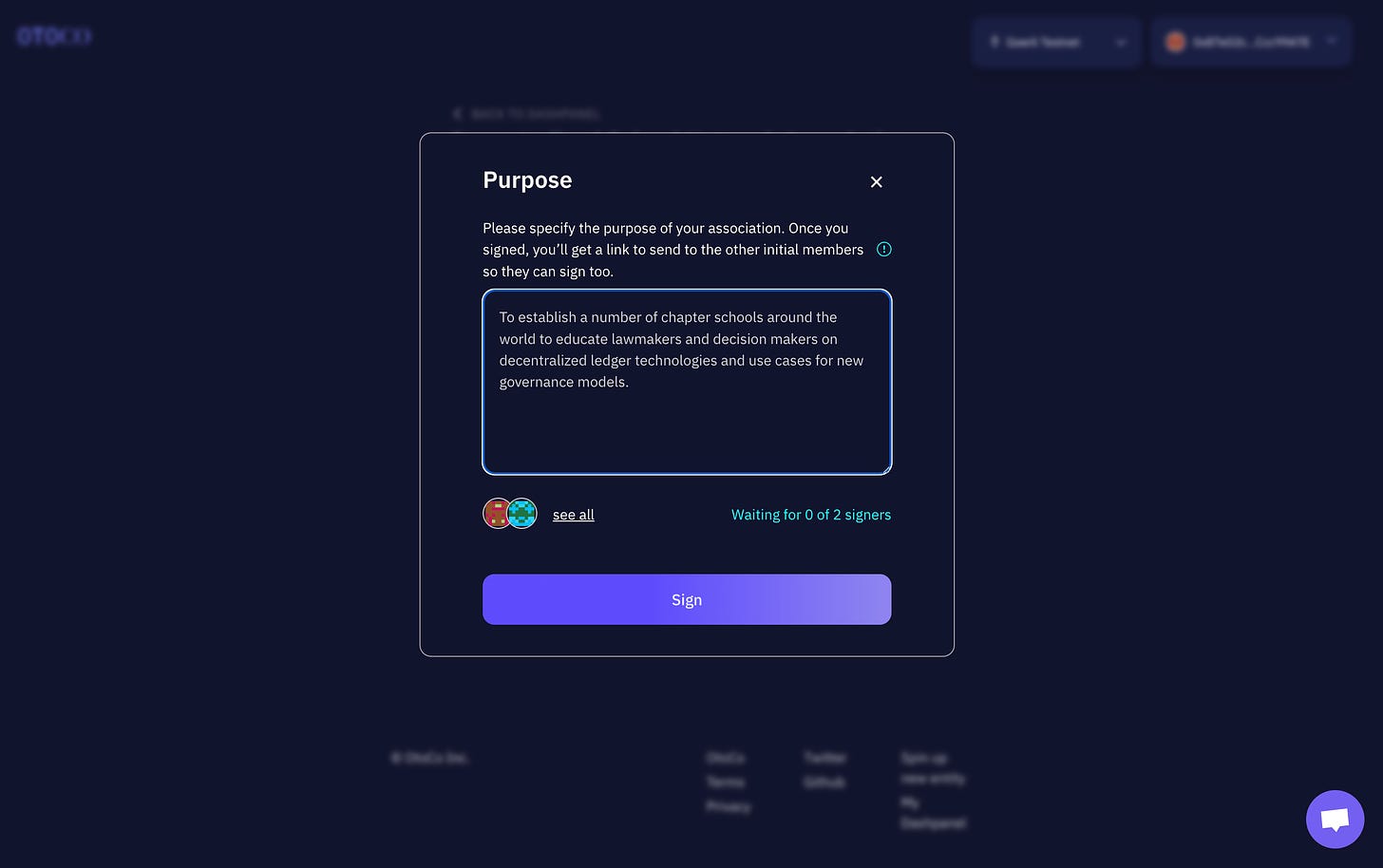

Once completed (this may take around one minute), you will be asked to specify the purpose for your association:

> It is important you think carefully about this purpose before you click Sign as it is the very reason for existence of your association!

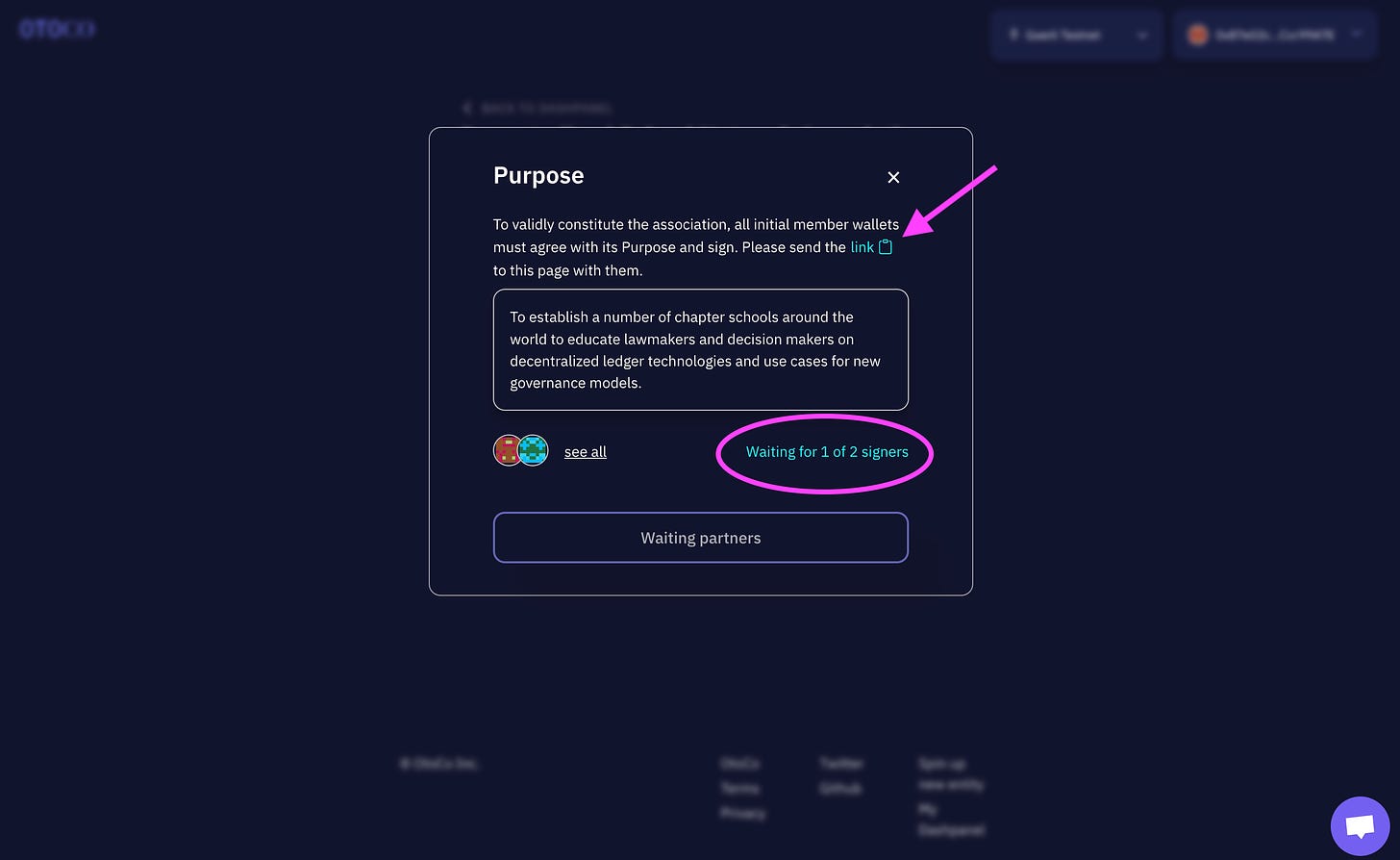

Once you signed as first member, you will need to make sure the other initial members of the association also sign.

You can do so by sending them the link shown in the Purpose console, which also shows how many of the initial members already signed:

Note: whomever you send the link to will only be able to sign if they are connected with the member wallet specified in Step 1.

Step 3: Activate!

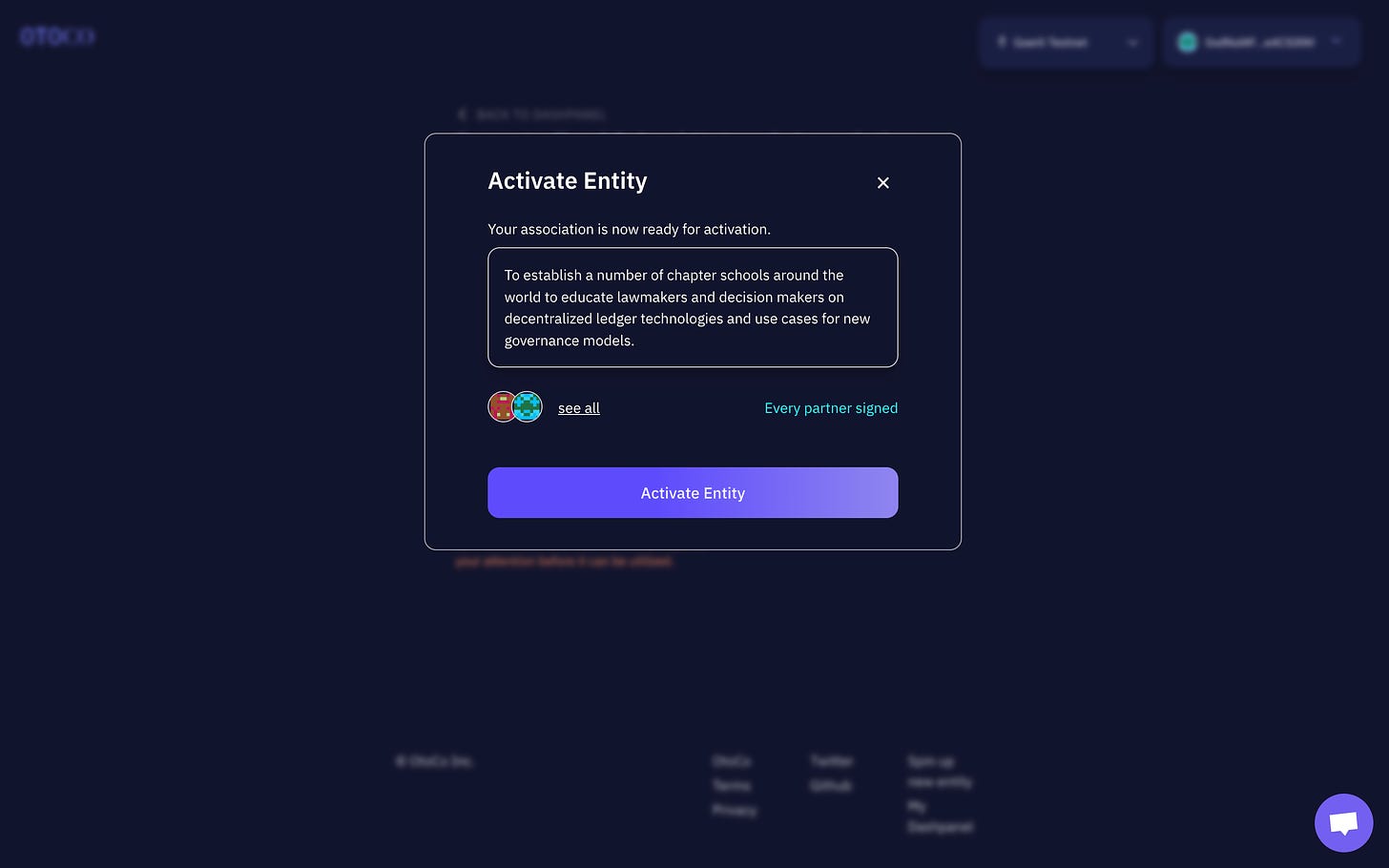

> Once all your initial members signed, you can Activate your entity:

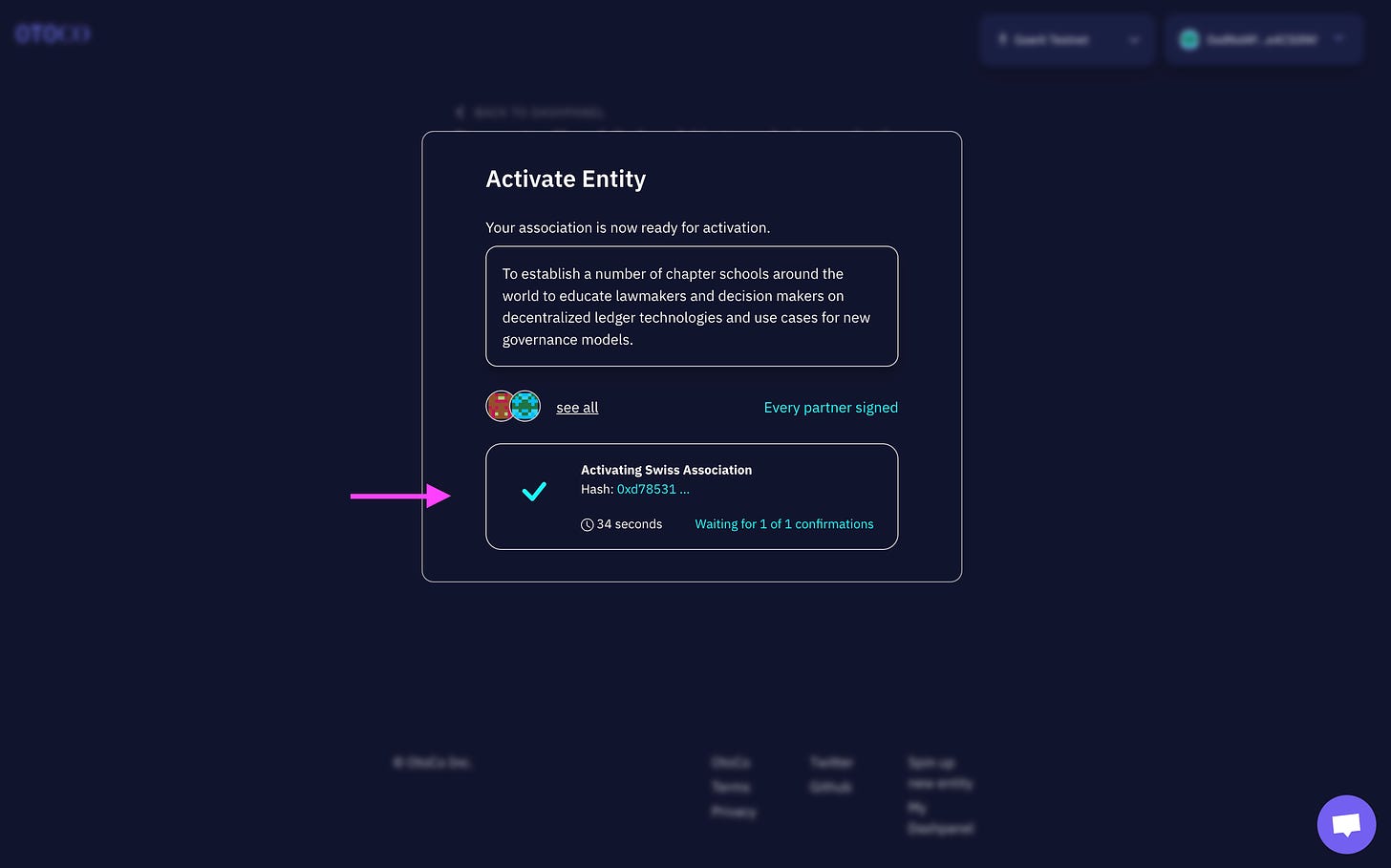

After you confirmed the activation transaction from your connected wallet, you will see a status screen indicating your new entity is being activated:

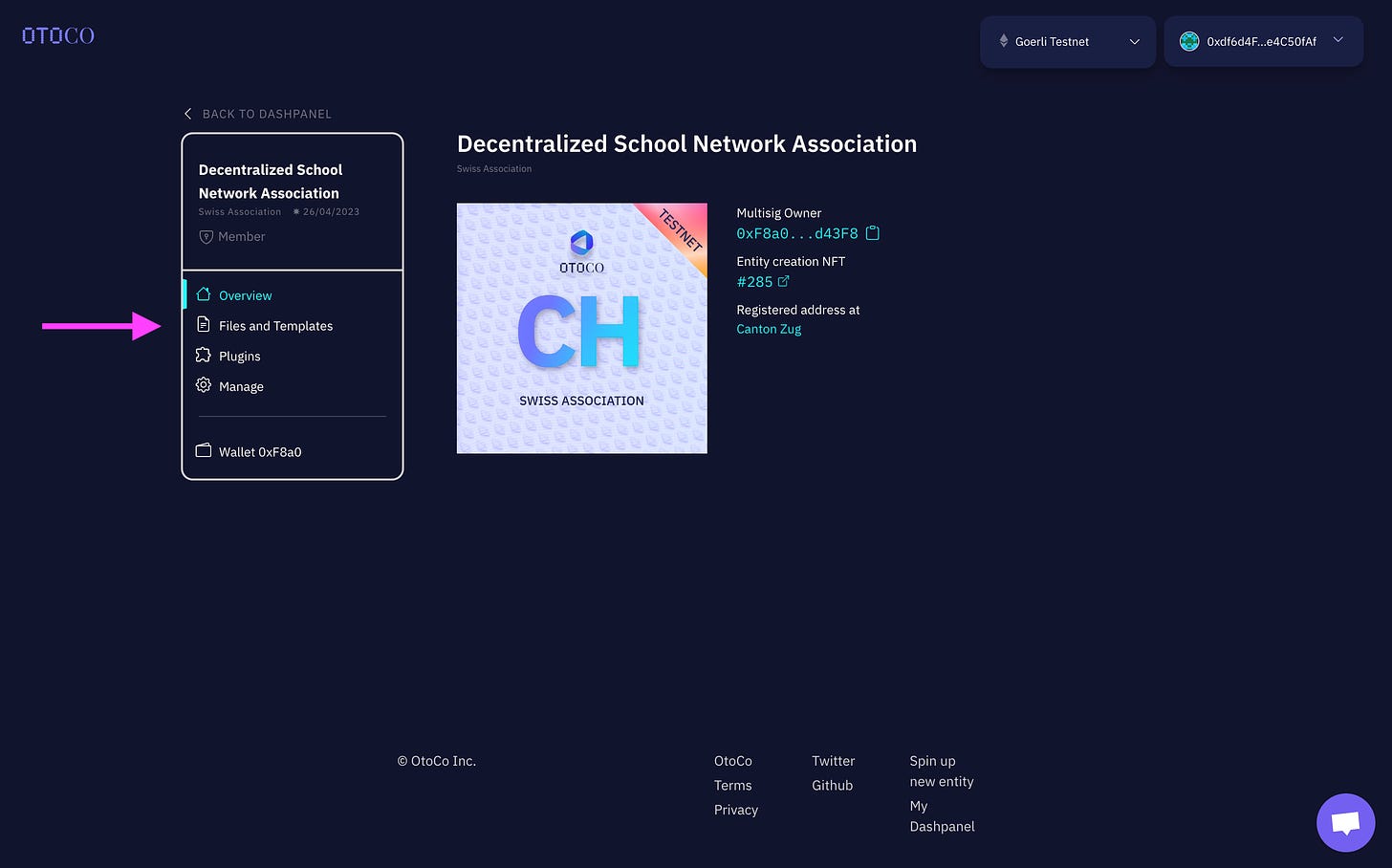

Once active you will be automatically redirected to the OtoCo dash and see your association live.

Among other functions in the dash panel, you will find the association’s Articles downloadable from the Files and Templates section.

Here are the ones for our specimen association: you can see that your onchain association maps to a real jurisdiction whilst living on blockchain: https://docsend.com/view/5qj4a95hv58gfm88

Congratulations!

You just created a blockchain-native Swiss association with will give you limited liability to further your common purpose. Now back to BUIDLING!

SUMMARY

A Swiss association, for all the reasons discussed above, can act as the missing piece in the entity stack of a decentralized project:

- It can either be the umbrella org for a Web3 project with distributed collaborators who can share resources at the association level. If such collaborators are DAOs, they can use the association as a USB-type port to access real-world services such as banking, payroll, health care, etc.

- Or it can be created for a sole core unit of a Web3 project looking for instant limited liability, tax efficiency and ease of operation.

- In both cases, the Swiss association, using OtoCo’s smart contracts, can be instantly formed for the equivalent of only US$99 in ETH, simply by two initial member wallets co-signing its Articles of Association as an expression of their agreement on common purpose.

- These initial member wallets can be controlled by individuals but can also be multi-sig wallets and, by extension, DAOs. In addition, by using the tokenizer plugin from the OtoCo dash panel, you can make any member wallet the director of the association and even create a Board consisting entirely of DAOs.

- With this new onchain limited liability entity, OtoCo provides the Web3 community with an extra legal lego outside the United States, at a time when many crypto teams are considering setting up shop abroad.

> Test drive an association on testnet now or connect with a mainnet wallet to summon your blockchain-native Swiss association on OtoCo today.

1 "association" in French "associazione" in Italian.

2 Unless they conduct a “commercial operation” (see Part II regarding the association’s non-profit nature).

3 This means that the association can remain very lightweight on assets and can in theory not have any, so they would not have to pay taxes on assets.

4 There are potentially issues of the association seeking to limit its liability from malpractice suits against one of its members, and there may be a greater chance of conflict of interest between the partnerships part of the group.

5 Note that being a member of an association does not however protect its members from liability in the jurisdiction they operate in: If a core unit prefers to operate as a DAO, its membership of an association will not limit the potential liability of DAO token holders from legal enforcement in the place where it is deemed to operate, since DAOs are, in the default analysis, considered unlimited partnerships.

6 However, a full audit is mandatory by external auditors if any two out of three of the following criteria are met over two successive years:

- CHF 10 million in total assets;

- CHF 20 million turnover;

- 50 full-time staff total annual average.

7 According to article 65 CC, the General Assembly has the primary power to appoint the Board members. The initial Board members are appointed by the association’s first members and after that, new members of the Board are appointed by the General Assembly. However, it is possible to provide for different modes of appointment, including the delegation of the Board’s power to another body, and criteria and conditions for new members of the Board can be set.

8 https://www.unine.ch/files/live/sites/florence.guillaume/files/Publications/Riva%20DAO%20in%20Swiss%20legal%20order.pdf